38+ mortgage not showing on credit report

Web On Credit Karma when you view your report there is a section about Mortgages - it says None. The lenders reporting time.

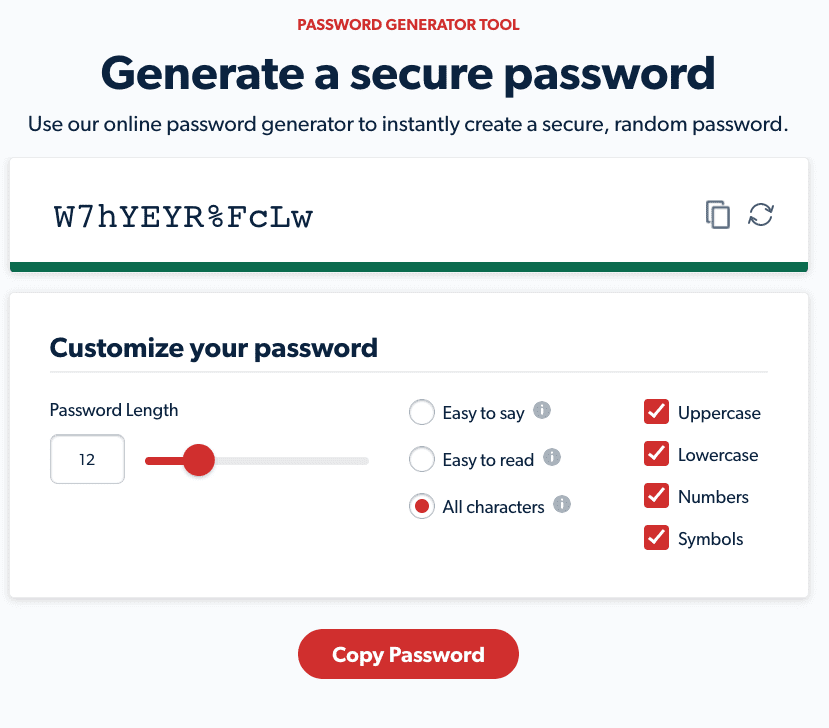

9 Steps To Take To Keep Your Money Safe

Not all lenders and creditors report to all three nationwide credit bureaus.

. However the account should be updated to show it is now paid in full through the refinance. Consider setting up free credit monitoring so you can keep tabs on how paying your mortgage affects your credit score over the long term. That could be payments to the original creditor to a debt collector or to a debt management firm.

Web You should file a dispute with the credit bureaus about the error. Web Most mortgage lenders want to see the last three months of bank statements some ask for six months. Web If the collection agency does decide to report the debt to Experian both the original account and the collection account can appear on your credit report.

The previous account will remain as a record of activity. Web What to Do if Your Mortgage Doesnt Appear as Paid on Your Credit Report. If they say they report information but the mortgages do not appear on your report you need to find out why and correct the situation.

There might be an error in the loan papers. Web Because your credit report serves as a history of all your accounts refinancing your loan with a new lender doesnt mean the old loan and its history will be removed immediately from the report. Web Airdrie AB.

Web Contact your mortgage lender and ask why they have not reported your mortgage account to us. Web ClearScore shows you your report from Equifax. Different credit bureaus use different credit scoring models.

Web There are a couple of reasons why some accounts may not be listed on your Equifax credit report. Web To make sure your payments are being reported to credit bureaus check your credit report for free to see if your mortgage is listed in your accounts. You typically wont be able to get one of these on your own.

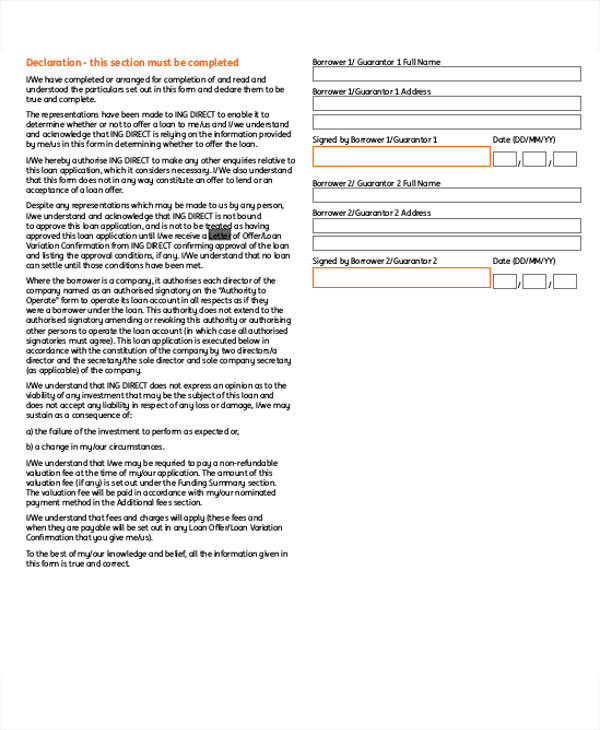

Web If you are upside down on the mortgage reaffirming the debt might not be the best option. Department of Housing and Urban Development HUD-approved housing counselor. These statements show if you are making payments to debts that are no longer on your credit record.

There are certainly pros and cons to reaffirming a mortgage when. Web You can find out by reviewing your credit reports or asking your mortgage companies directly. If an installment loan is not appearing on your credit reports contact the lender and also the credit bureau to update the information.

Web Mortgage lenders may be using the tri-merge credit report or they may be using the more in-depth residential mortgage credit report or RMCR which they obtain from a third-party company that specializes in them. It could be something as simple as a clerical error or a typo on your social security number. The lenders reciprocal data sharing agreements.

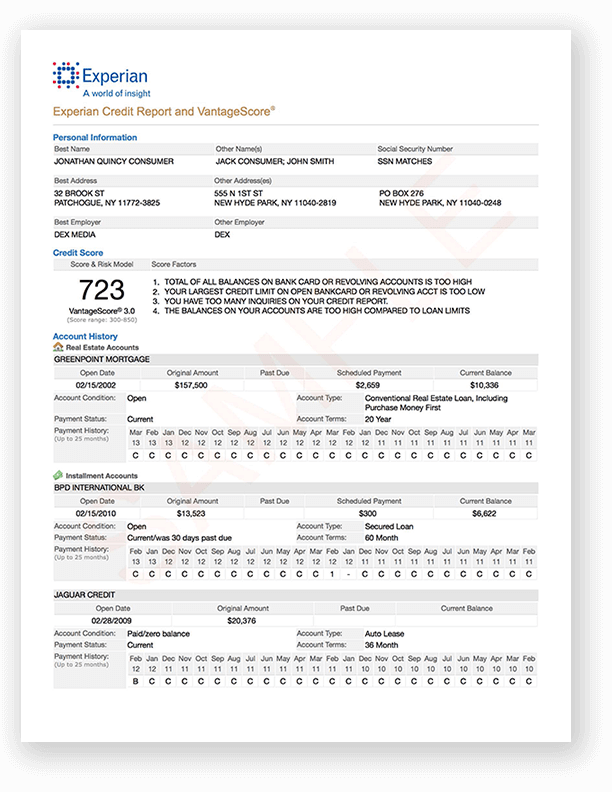

Web Credit report scores are based on many factors including your pay history on your installment loans. Once reported a collection account can remain on your credit report for seven years from the original delinquency date on the original account. There is no active mortgage on your latest credit report.

So my borrowell account doesnt show that I have any mortgage attached to my credit. The details searched to generate the Credit Report not matching the information on the mortgage account. Some report to only two one or none at all.

Web Theres a reporting delay One of the most common reasons you dont yet see your mortgage on your credit report is because theres been a simple reporting delay. Closed accounts may have dropped off. Web If your mortgage is not listed on your credit report based on these reporting rules you cant do anything to work around them.

There are issues with your address The UK doesnt have a national ID card system so credit reference agencies rely on your address to confirm your identity and match your credit information. Dont see what youre looking for. For most people it can take anywhere from 30 to 90 days for a new or refinanced loan to appear.

So if your lender doesnt report to them the account wont appear on your ClearScore report. You can check with your lenders and creditors to find out which bureaus they report to. I have been paying a Mortgage on my house for just over 4 years with HSBC the whole time.

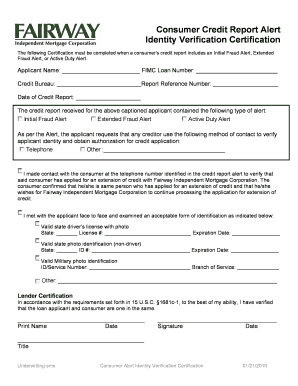

Its saying You have no mortgage accounts listed on your credit report. Web Here are four reasons why a credit report might be missing payment information. You can also file a complaint with the CFPB online or call 855 411-CFPB 2372 to file a complaint and be connected to a US.

It can take 30 to 60 days for a lender to report a loan account closure to the credit bureaus so there may be a few months lag between when you make your last payment and when your credit reports are updated to reflect it. An error could include a transposed digit from your Social Security number or your name misspelled among others. Since borrowell pulls from Equifax it means Equifax doesnt have record of.

When in fact I have had a mortgage account for about 2 years now. Web There are four common reasons behind the unexpected absence of information on Credit Reports. Your creditor doesnt report to all three bureaus Creditors including credit card issuers banks and credit unions arent required to report your payments to.

If they decide to report they must first be validated by Experian as a legitimate creditor and sign a contract where they agree to report legally and accurately and respond to consumer disputes regarding their accounts. If you do have to walk away from the mortgage at some point you will still be liable for any deficiency. Is this something to be concerned about or does it not always show on things like this.

Free 6 Mortgage Quote Request Samples In Pdf

Mortgage Broker In Perth Mount Lawley Dianella Mortgage Choice

Tumbi Umbi Mortgage Choice Central Coast Mortgage Choice

How To Dispute Errors On Your Credit Report Find Correct Mistakes

How To Read A Credit Report Credit Report Analysis Retipster

How To Run A Credit Check On Your Customer With Experian Connect

How To Read A Credit Report Credit Report Analysis Retipster

Free 10 Sample Mortgage Application Forms In Ms Word Pdf

38 Free Editable Customer Report Templates In Ms Word Doc Page 4 Pdffiller

.png?width=500&height=357&name=DSCR%20LP%20Graphics%20(1).png)

Dscr Loans Visio Lending

38 Free Editable Customer Report Templates In Ms Word Doc Page 4 Pdffiller

Loan Offer Letter Template 9 Free Word Pdf Format Download

![]()

Why Does My Credit Report Not Show My Mortgage Moneysavingexpert Forum

Why Doesn T My Mortgage Appear On My Credit Report Experian

What Should I Do In Regards To Credit Cards As An 18 Year Old With No Credit History Quora

Mortgage Broker Home Loans In Richmond Windsor Mortgage Choice

If I M On The Title Of The House But Not Responsible For The Loan And It Is Stated And Signed How Can They Take The House From Me Quora